Kai-Zen Insurance: Protection for You and Your Family

Kai-Zen insurance is an innovative option that offers tailored coverage for those who want to protect the people and possessions that matter most.

Kai-Zen is a strategy that helps you maintain your current lifestyle in the event of a chronic illness, premature death, or an inability to sufficiently save for retirement.

What is so compelling and unique about the Kai-Zen strategy?

Participant contributions are leveraged

Protecting your earnings is critical to insuring your ability to save for retirement.

Due to limitations, traditional retirement plans are typically insufficient for high-income earners.

If you want to maintain your lifestyle in retirement, you need a proactive strategy that puts more money toward protecting your future income without putting a drain on your current finances.

- Kai-Zen makes it easy for individuals and families to sign up with our comprehensive plans and transparent pricing.

- Kai-Zen insurance providers offer convenient and flexible service. Customers can customize their policies to suit their individual needs and budget. Plans are designed to be easy to understand, with no hidden fees or charges.

- Kai-Zen insurance provides more than just financial security – it offers peace of mind. We are committed to providing excellent customer support before, during, and after the purchase process in order to ensure complete satisfaction with our product. With the services provided by Kai-Zen Insurance, customers can rest assured that they have the right coverage at an affordable price.

Kai-Zen Strategy

Why is Kai-Zen the right choice for you? By using bank financing, the Kai-Zen strategy allows you to realize benefits beyond your expectations while keeping contributions within your means. Additional benefits include:

- Potential income tax-free withdrawals (access to cash value using policy loans and withdrawals that may be income-tax free)

- Interest crediting potential (opportunity for interest credited based on market interest or a fixed rate)

- No loss of cash value, 0% floor (0% floor protects against declines in an index)

- Potential cash value growth is tax deferred

The Power of Leverage

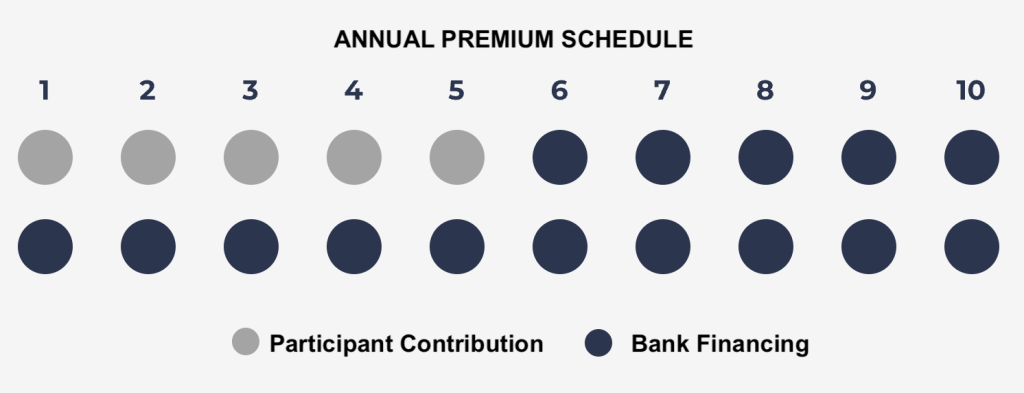

- $584,390 total combined contributions

- $418,000/yr potential tax-free distributions (when using policy loans)

- $10,868,000 cumulative distributions taken from age 65-90

- $2,761,321 remaining death benefit for beneficiaries net of all loan repayments

- * Sex Males, age 18

How Kai-Zen Works

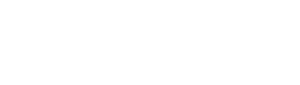

The Kai-Zen life insurance policy is jointly funded. The participant and bank financing both contribute. Bank financing is responsible for approximately 60-75% of total premiums to the policy.

Now, participants can realize benefits far beyond what their annual contributions alone could afford them.

Years 1-5:

The participant contributes their portion. The lender finances additional premiums into the insurance policy.

Years 11-15:

During this time, the policy has the potential to accumulate more value. The lender’s note will be satisfied by approximately the end of the 15th year.

Years 6-10:

After year five, the participant’s obligation will be complete. The lender makes the remaining premium payments.

Years 16 and Beyond:

Potential policy cash value accumulation is projected for distributions for lifestyle needs such as supplemental retirement income.